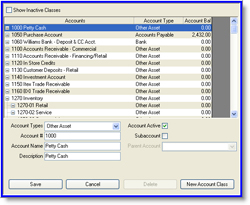

Chart of Accounts

The chart of accounts capabilities within the tool are broken into accounts and classes. While accounts describe the transaction, classes group the transaction based on the location or business entity, such as a store or warehouse location. Both accounts and classes support up to five levels of substructure.

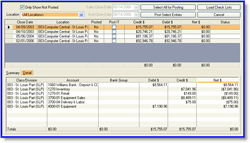

Automatic Journal

The following journals are automatically generated and posted by the tool: Sales, Purchase, Cash Disbursement, and Bank Reconciliation. After review and approval by accounting, Sales Journals are generated and posted. Sales, receivables, payments, and cost of goods sold are based on daily closeouts for each location. Purchase Journals are generated and posted as a result of entering an accounts payable invoice. Cash Disbursement Journals follow the completion of a check run within the invoice payment process. Bank Reconciliation Journals reflect discrepancies between the bank statement and the bank statement reconciliation, as well as any applicable bank fees.

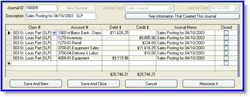

Manual Journal

Manual journals may be made to the general ledger at any time. Journals may be memorized within the system and reused. Additionally, a journal may be defined such that it will be automatically reversed at the start of the next accounting period.

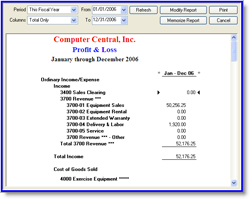

Financial Reporting

General ledger reporting capabilities within the tool generate two primary types of reports: Profit/Loss Statements and Balance Sheets. Each type of report allows comparisons to a previous period, previous year (same period), year-to-date, and previous year (same year-to-date). Other options within both reports allow comparison of individual account values based on percent of row, percent of column, percent of income, percent of expense, dollars change, percent of change, and percent of year-to-date, where appropriate. Once a report has been customized, the configuration can be saved and applied to future report generation.